Reducing Early DD Timelines from Months to Minutes

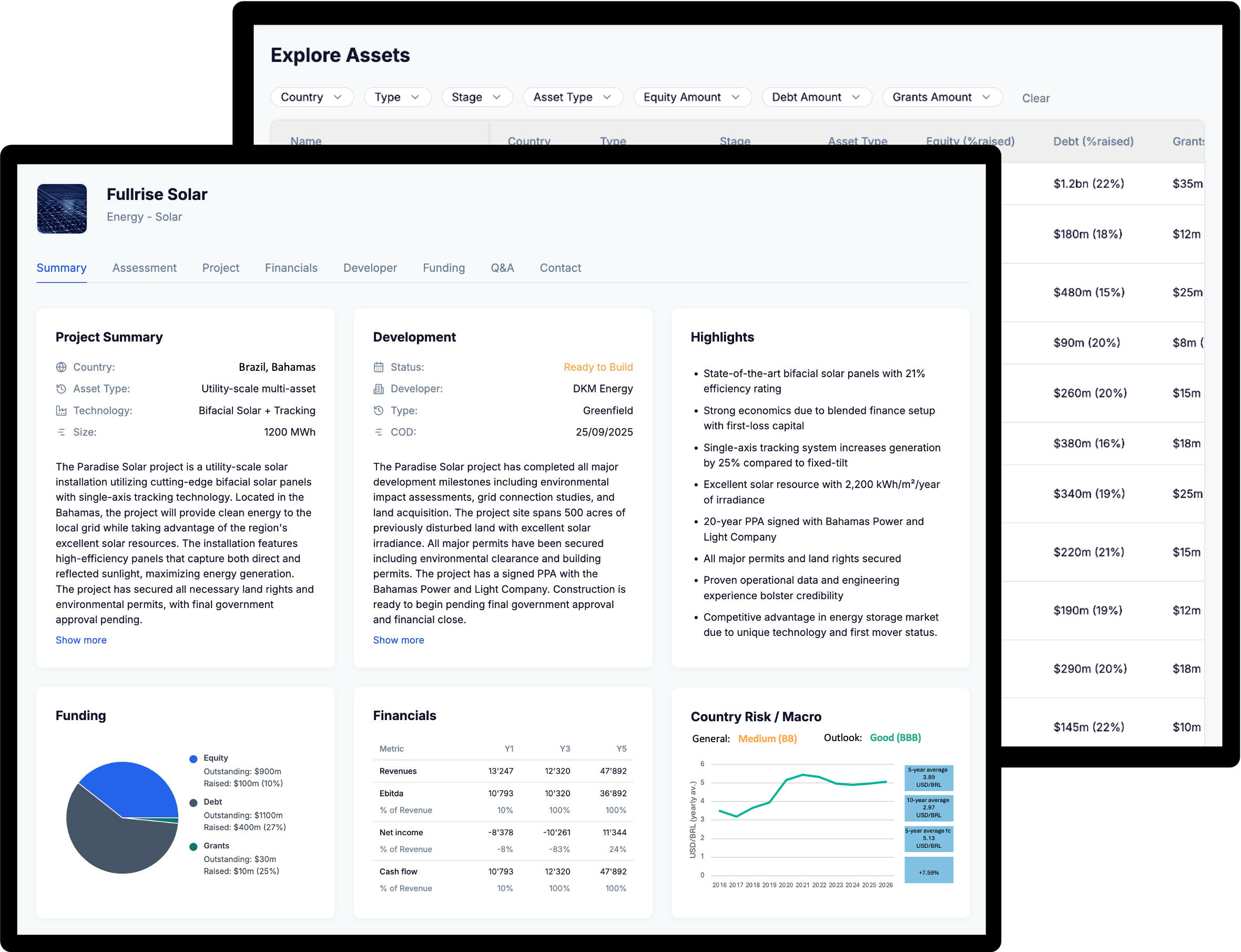

The objective was to heavily leverage multiple language models and algorithms to extract unstructured data from highly unstandardized company information and create Private Equity/Debt grade investment information from them.

The main challenge in this industry is that document and information formats highly depend on deal stage, size, industry, and company/project type. This inconsistency requires significant data standardization before meaningful analysis can begin, traditionally consuming months of analyst and associate time.

We built a sophisticated backend of multiple AI agents and specialized algorithms that process financial, text, and image data to extract key information relevant during early due diligence for investors. The system can identify and standardize data from various sources including financial statements, pitch decks, market reports, and unstructured communications.

The platform utilizes data vectorization to allow swift ongoing due diligence and automates communication between management and deal teams to alleviate the time requirements throughout fundraising. This approach not only accelerates the initial assessment process but also creates a structured knowledge base that continues to provide value throughout the entire investment lifecycle.